Center City Housing Market Still Strong, But…

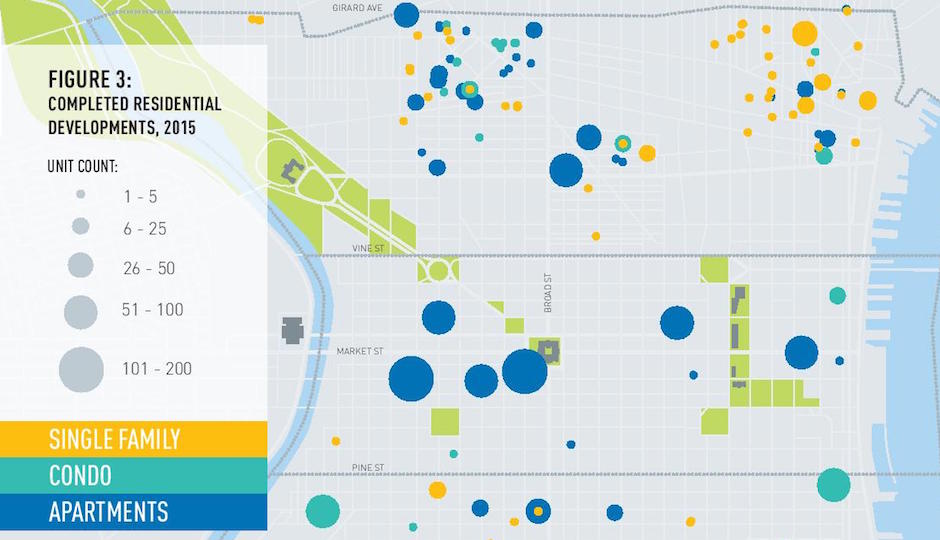

This map shows where, how many, and what type of housing units were built in the Center City core in 2015, along with parts of the extended zone. Map | Center City District

Though the pace has slowed a bit from the torrid level of 2013, new housing continues to be produced in Greater Center City at a rapid clip, according to the latest Center City District report (PDF) on “Sustaining Demand for Downtown Housing.” The growth over the last three years has been driven overwhelmingly by rental housing, which accounted for 64 percent of the 1,538 new housing units completed in 2015. According to the report, the explosion in new housing production in Greater Center City—the area between the rivers from Girard Avenue to Tasker Street—is in line with both population growth and growth in demand. But to keep this demand strong, more attention will need to be paid to growing jobs, retaining younger residents, and by extension providing decent schools.

Almost all of the new housing added within the core of Center City—the original 1682 city from river to river, Vine to Pine—has been rental units: 604 of the 614 new units built in the core were apartments. Single-family residential construction has largely taken place in the “extended” Center City area, encompassing neighborhoods like Northern Liberties, Fairmount, Pennsport and Graduate Hospital. In the southern portion of the “extended” Center City, single-family homes were the single largest category of new housing built last year (209 of 438 units), while in the northern portion, apartments (382 of 924 units) edged out single-family homes (353 of 924).

Rising rents and declining vacancy rates point to continued strong demand for rental housing in the core, according to the report: an analysis of buildings built since 1991 by Delta Associates showed that rents in these “Class A” properties rose 3.1 percent citywide last year while vacancy rates fell from 5.7 percent to 2.8 percent.

Overall, these numbers point to sustainable growth in the years to come, but some other numbers indicate that the city will have to put some effort into sustaining it. One of the areas where effort will be required is in retaining population. The boom in rental housing is driven largely by the preferences of Millennials, who are now between the ages of 25 and 34 and make up the single largest cohort of Center City residents. Had Center City retained all 50,000 of the 20- to 34-year-olds who lived there in 2000, there would be 17,000 more 35- to 49-year-olds living there now. But 20- to 29-year-olds are part of the most mobile cohort of the general population, and their locational choices are largely driven by where they can find good jobs and, as they enter child-raising years, where they can find affordable, quality schools.

On both of these metrics, Philadelphia lags both its region and the nation. While all of its Pennsylvania suburban counties added jobs from 1990 to 2014, Philadelphia lost jobs during that same period, and the more recent job growth in the city since 2010 is half the national level and lags the suburbs by two percentage points. And while the increasing involvement of younger parents in neighborhood school support groups such as Graduate Hospital’s Friends of Chester Arthur holds out hope that newer Philadelphians will help improve the quality of city schools through their own efforts, the funding picture for the public schools means they will be fighting an uphill battle, and many parents may still simply move to suburban jurisdictions with better (and better-funded) schools.

The CCD’s report concludes that the best thing the city can do to sustain the current pace of housing growth is to “commit to public policies that facilitate job growth throughout all neighborhoods.”