Audit: City Pension Fund Still Going Broke

Photo by Jeff Fusco

Auditor General Eugene DePasquale released his annual compliance audit of Philadelphia’s city pension fund today, and it has some grim news: The city’s funding ratio—the amount of cash it has on hand relative to what’s needed to pay all its pension obligations—is at its lowest level ever.

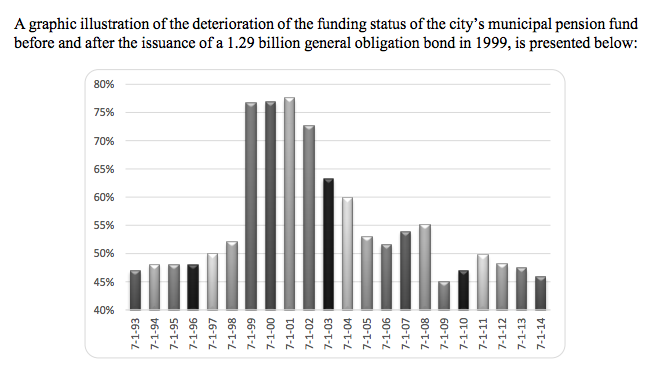

According to city figures, the pension fund has only 45.8 percent of the assets needed to meet its obligations. That’s way down from the 77.5 percent it had in July 2001, two years after the city floated a $1.29 billion general obligation bond and put its proceeds into the pension account.

A chart released along with the compliance audit shows that the 2014 funding ratio is even lower than the roughly 47 percent balance the fund had in 1993.

“We are extremely concerned about the historical trend information contained in the schedule of funding progress included in this report,” the introductory letter states.

A graphic from the audit shows how dire the pension-funding crisis has become.

A state law passed in 2009 sets up a distress recovery mechanism for severely underfunded pensions. The law also exempted Philadelphia from its provisions, but that exemption expires January 1st. Under its terms, the city would be at Level III (“severe distress”). Under the recovery law, Philadelphia would have to establish a revised pension plan, presumably less generous, for new employees, could require those employees to contribute more to their pensions, could reduce pension payments for up to six years, and would have to report to the state how it plans to improve its fund administration.

“City officials must realize that there are no short-term fixes and that they must make fiscally responsible decisions” to meet its obligations, the auditors concluded.

Patrick Kersktra wrote a still-pertinent article about the costs of the pension crisis for PhillyMag back in 2012.