Wolf Proposes Gas-Drilling Tax

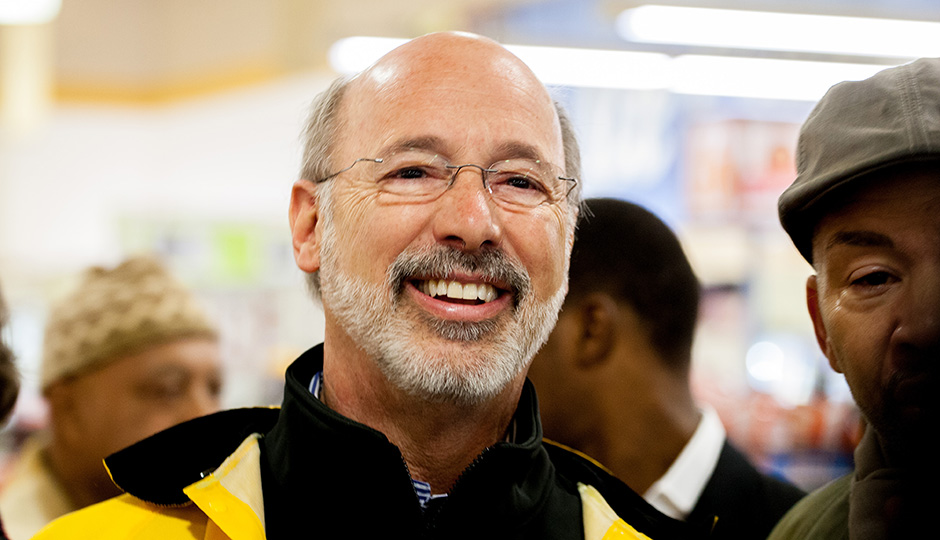

Gov. Wolf | Photo Credit: Jeff Fusco

As expected — because it was one of the main planks in his winning gubernatorial campaign — Gov. Tom Wolf today formally proposed a 5 percent tax on natural gas drilling in the Marcellus Shale.

The tax would raise a billion dollars, his administration said, with money directed toward education funding. The proposal is modeled on a similar tax imposed in West Virginia.

“We can get Pennsylvania back on track, and we can start by passing a commonsense severance tax that will help fund our schools – an idea with bipartisan support,” Wolf said in a press release announcing his proposal. “This is the right thing to do for our children and our economy and to move Pennsylvania forward.”

His proposal joins several others that have been unveiled in the last week or so, including an 8 percent tax plan offered by a pair of Philly Democrats, and a 3.2 percent tax plan offered by Rep. Gene DiGirolamo, a Bucks County Republican.

Wolf sent the following policy memo to Pennsylvania legislators to promote his proposal:

Pennsylvania’s schools have suffered from $1 billion in funding cuts and a lack of resources. We have seen larger class sizes, fewer teachers, and program cuts that make it more difficult for students to get a strong education in Pennsylvania’s public schools. If we are going to get our Commonwealth back on track and be competitive in the 21st century economy, we must provide our young people with the educational foundation necessary to be successful. Pennsylvania currently ranks 45th in the nation in the percentage of funding the state provides for public education. This is intolerable. Pennsylvania must take the lead in investing in early childhood, K-12, and higher education.

With Pennsylvania sitting on one of the largest deposits of natural gas in the world, it is up to us to use this resource wisely so it benefits all Pennsylvanians and helps to fund our schools. Pennsylvania is currently the only major gas producing state in the country that does not charge a tax on oil and natural gas extraction – and we’re failing to tax this resource at a time when our schools need more funding. If states like Texas, West Virginia, and Oklahoma are able to charge a severance tax to fund key priorities, it is long past time Pennsylvania does too.

In order to ensure that we are appropriately funding education at all levels, I am today proposing the Pennsylvania Education Reinvestment Act. This will raise needed new revenue for our state’s public education system by imposing a reasonable tax – in line with our neighbors – on the extraction of natural gas within the state.

The tax proposed in the Education Reinvestment Act will be modelled after the severance tax in neighboring West Virginia, which like Pennsylvania has seen a recent boom in production of natural gas from unconventional drilling. Implementing a similar structure to West Virginia will ensure that Pennsylvania is competitive with neighboring states. In addition, this approach has the benefit of being field tested. West Virginia offers proof that a state can build a thriving unconventional natural gas industry while simultaneously using a portion of the proceeds to help make a better future for its citizens.

I am proposing a 5% plus 4.7 cents per MCF tax. My proposal would not be on top of the existing impact fee but includes it. My proposal would continue the payments made to communities impacted by drilling that are currently funded by the impact fee.

We can get Pennsylvania back on track, and we can start by passing a commonsense severance tax that will help fund our schools – an idea with bipartisan support. At a time when our budget is facing significant challenges and our schools are struggling, it simply makes sense to pass a competitive, commonsense severance tax.

Key Features

Tax of:

·5% of the value of gas at the wellhead;

·4.7¢ per thousand cubic feet of volume severed.Reasonable exemptions for:

·gas given away free;

·gas from low producing wells;

·wells brought back into production after not having produced marketable quantities of gas.A tax with this structure is expected to generate over a billion dollars in fiscal year 2017 with revenue expected to grow with production. This number is based on the following estimates of production from both conventional and unconventional wells:

· 2015: 4,915.0 bcf

· 2016: 4,978.2 bcf

· 2017: 5,065.3 bcf

· 2018: 5,114.0 bcf

· 2019: 5,186.2 bcf

· 2020: 5,265.5 bcfFinally, the Education Reinvestment Act will contain provisions to protect property owners who lease land for natural gas exploration. No portion of the tax imposed in this legislation will be allowed to be deducted from royalty payments.

# # #