How Philly’s Bioscience Sector Is Driving the City’s Next Big Real Estate Boom

More than a million square feet of lab space are under construction to house the region’s leading life sciences companies and biotech entrepreneurs.

More than a million square feet of Philadelphia lab space are under construction. Rendering courtesy Sheward Partnership, illustration by Brooks Robinson

Philadelphia’s life sciences sector is right about where Michael Jordan was in 1989.

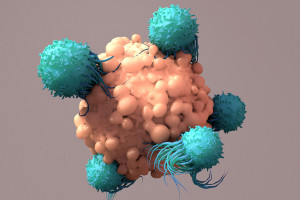

If you’re into sports history, you know 1989 was a break-out year for Jordan, one in which he’d score the first of many history-making, game-winning shots. And even though it would be two years before he’d win his first league championship — and another two years before he’d carry his team to its first three-peat, earning its dynasty title in the process — if you hadn’t noticed Jordan before then, that was the year you started to pay attention. For Philly, 2017 was the year the city’s life sciences sector clinched “the shot.” The city celebrated two first-of-their-kind FDA-approved gene and cell therapies to treat specific types of cancer and blindness. And by the end of 2019, things were looking more promising than ever.

The major breakthroughs had led to increased venture capital investment in Philly’s life sciences sector, accounting for $745 million in deals in the year 2019 alone. Then, the world’s largest real estate services company, CBRE, ranked Philly number eight on its 2019 top 10 list of the nation’s leading life sciences hubs, and it became clear that we were no longer merely emerging. Like rival life sciences clusters in Cambridge, Massachusetts, and Silicon Valley, Philadelphia had cultivated a concentration of talented scientists, deep-pocketed funders, and collaborative lab space and had officially become a destination for science innovators from around the world.

The distinction is vitally important for the city and its future. This relatively newfound status as a leading life sciences hub means the innovations that are born here — and the economic impact they spur — stay here. When young researchers make discoveries at the city’s universities, they’re more likely to stay and build their companies here. Those companies bring new opportunities for employment in the life sciences sector, which already accounts for as many as 45,000 area jobs. The employees of those companies will undoubtedly settle their families here, pay taxes, and invest in the region’s real estate market. All of this leads to a stronger local economy and will ultimately cement the life sciences as a crucial part of the city’s character.

“The more Philadelphians, and the world, begin to understand that Philadelphia is the place to be for cell and gene therapy, the more that’s going to change our identity,” says Sam Woods Thomas, director of life sciences and biotechnology for the City of Philadelphia. “We’re already seeing companies hiring and bringing lots of workers here. The recent major development projects in the life sciences are further proof that Philadelphia is the epicenter for cell and gene therapy research — an industry that’s of critical importance as it continues to grow and contribute to our city and region’s economy. I think that’s really going to modify the identity of Philadelphia and put us on the map.”

However, the explosion of biotech and life sciences activity means researchers have now outgrown the available lab space. By the end of 2019, according to a study commissioned by the city and the Philadelphia Industrial Development Corporation, University City was facing an extremely low two percent lab vacancy rate, with little inventory elsewhere in the city. With scientists clamoring for more lab and manufacturing space, developers in the region responded by launching new construction projects in and around the city and renovating legacy pharmaceutical campuses in the suburbs.

Currently, more than one million square feet of lab space are under construction in and around Philadelphia; once complete, they’ll house the region’s leading life sciences companies and biotech entrepreneurs. While the COVID-19 pandemic brought many industries to a standstill, developers in Philadelphia’s life sciences sector have pushed through to keep some of the region’s most anticipated commercial real estate projects on track. Some have done so with the help of additional state and federal government funding awarded to support the research these sites enable, because, after all, life sciences research could be the very thing that brings the pandemic to an end.

The center of this flurry of life sciences real estate action is University City, one of the most desired sections of the city for researchers and science professionals due to its proximity to universities and academic medical centers like Drexel and Penn as well as to a major transit hub, 30th Street Station.

Just across from 30th Street Station, several pieces of Brandywine Realty Trust’s $3.5 billion mixed-use Schuylkill Yards project have thus far been devoted to life sciences. In April, the real estate investment trust began converting 3000 Market Street to include a mix of office and lab space for Spark Therapeutics. The second phase involves adding a 472,000-square-foot life sciences building with lab space at 3151 Market Street, plus an additional tower planned for 3025 JFK Boulevard.

According to Jeff DeVuono, executive vice president and senior managing director of BRT’s Pennsylvania portfolio, who oversees leasing at Schuylkill Yards, his team has enlisted the help of its architects to research the trends that COVID-19 has accelerated. “With all development right now, we’ve had to take a step back and ensure we’re designing for a post-COVID world, even though no one can be sure what that will look like yet,” DeVuono says. “We’ve seen more consumers become hyper-aware of how important some of these new technologies are, like touchless building features, state-of-the-art HVAC and air filtration systems, optimized fresh air intake, access to the outdoors and more, all of which are featured in our lab and research project at Schuylkill Yards.”

Less than a mile away, at 38th and Market streets, real estate developer Wexford Science & Technology is continuing the development of uCity Square in partnership with the University City Science Center and health-care real estate investment trust Ventas. A 2015 formal partnership between the Science Center and Wexford and a later partnership between Wexford and Ventas resulted in the development of the current uCity Square community, which spans more than three million square feet of existing labs, offices, incubators, residences and more and houses 200-plus companies. The partners now have more than 1.35 million additional square feet under construction, including One uCity, which will anchor up to eight additional mixed-use buildings.

John Grady, SVP and Northeast region executive for Wexford, believes the uCity project will attract and grow a broad and diverse talent pool, making it a catalyst for further job growth in the sector. And while the pandemic led to historic unemployment, many of the hub’s existing tenants continued to work in lab spaces when COVID-19 hit, researching health-care solutions, therapies and vaccines.

“COVID has reinforced the resilience of the life sciences real estate asset class and the essential nature of lab space to support critical research and commercialization efforts,” Grady says. The new uCity project experienced some lost time due to the shutdown of construction and the temporary disruption in financial markets, but Grady says all projects are now back under construction and are expected to be completed by the end of 2022.

Across the river in Grays Ferry, Penn is continuing its expansion of Pennovation Works, a 23-acre innovation campus. Since 2010, Penn has been working to convert a former research and paint manufacturing facility into a blend of modern offices, labs and production space. The multi-phase project began with the 2016 completion of its business incubator, Pennovation Center. The Pennovation Lab building is the latest in a series of major facility investments Penn has made to develop what it calls “a complete innovation ecosystem.”

Amid COVID-19, the Pennovation Lab project halted construction for six weeks while the project team set up the proper health and safety protocols for construction workers. The temporary pause pushed back the August 2020 completion date for the base building core of the project.

Pennovation Works managing director Anish Kumar says the new 65,000-square-foot lab is designed to provide space for scientists and researchers who have reached a critical stage in the evolution of their companies. “This project is especially important for graduating companies from the Pennovation Center or other incubators that have secured early-stage funding, outgrown their incubator space, require 2,000-to-6,000-square-foot wet lab suites with potential for incremental growth, and are unable to make long-term commitments due to the dynamic nature of their growth trajectories,” Kumar says.

These projects and several others under way in University City will result in a transformation of the University City neighborhood, the city’s skyline, and the region’s standing in the science innovation community. But part of what makes Philly’s life sciences innovation sector unique is that it isn’t confined to one geographical area. Other major life sciences clusters, geographically, have little room to grow.

“Places like Cambridge, as fantastic as they are, just have one innovation space. In addition to University City, we have the Navy Yard, plus expansion in places like Grays Ferry and Old City, with the Curtis Center. And we have all of our partners out in the suburbs who are coming to work with the innovators here in Philadelphia,” the city’s Thomas explains. “So I really see our strength as being regional, as opposed to Philadelphia-centric. And I think we’re all going to do well together. Philadelphia is certainly the reason why all these companies are coming here, but to have these auxiliary locations — that can only help us, and our existence can only help them.”

While University City is the center of action, the Philly region’s suburban communities, whose sprawling lands have housed some of the world’s largest pharmaceutical companies and research and development manufacturing facilities, are home to just as many promising developments.

In King of Prussia, developers Brian O’Neill and biotech exec Audrey Greenberg have joined forces with New York City-based health-care investment firm Deerfield Management to develop a project boldly called the Center for Breakthrough Medicines. The 630,000-square-foot cell and gene therapy manufacturing facility will be erected on the site of the existing Discovery Labs innovation hub. When complete, the site will offer 1.6 million square feet of contract development and manufacturing organization space, research and development labs, administrative offices, dining, daycare and fitness amenities. Despite some delays due to COVID-19, Greenberg says, O’Neill’s ambitious goal of having the Center for Breakthrough Medicines, which broke ground in December 2019, fully operational and occupied by the end of 2021 is still largely on track, and they’ve continued to recruit and welcome new tenants to the site.

University City is the center of the action, but the region’s suburban communities, which have housed some of the world’s largest pharma companies, are home to just as many promising developments.

“Lack of activity for a short period of time at the outset of the pandemic quickly reversed into intense interest caused by on-shoring efforts from supply chain disruptions, the need for vaccine manufacturing capacity, and private and public market focus on biotech — the industry set to save us from COVID-19,” Greenberg says. “The team has remained nimble and quickly found ways to enable scientists and biopharma companies by connecting via virtual means. In some ways, this ‘new normal’ resulted in increased efficiency as well as a wider global reach.”

Meanwhile, MRA Group is developing a lab building that has nearly two dozen tenants — almost half in the life sciences industry — at Spring House Innovation Park, a 133-acre campus that the group acquired in 2017. MRA Group had already spent some $50 million renovating the campus’s 1960s-era infrastructure to include a host of energy-efficient features and outdoor attractions that before the arrival of COVID were merely nice amenities. Now, the site’s reconfigured HVAC system brings in more fresh air; the increased exchange rate can help reduce the amount of recirculated air that could carry COVID particles. And the campus’s outdoor spaces, including a fire pit and fitness court, have become safe spaces for employee gatherings.

“While we didn’t strategically plan for this project to be COVID-proof, we were very intentional about investing the dollars up front in infrastructure, because we knew how important that would be to the overall viability and marketability of the campus,” says MRA Group’s vice president of strategic initiatives, Phil Butler.

In Bucks County, the Pennsylvania Biotechnology Center (PABC), already home to 41 small-to-mid-size science, research and biotechnology companies, recently began construction on a new building to provide 15,000 square feet of new lab space, plus offices, conference rooms, and a 200-seat event hall. The PABC received more than $4 million in funding from the state and a $4.7 million grant from the U.S. Economic Development Agency for its expansion. The most recent state grant is funding renovation of existing space to add research and training labs and new offices to be used for research and development associated with COVID-19. And because the PABC project is partially funded by government grants, its expansion must be completed by October 2021 — notwithstanding the pandemic.

“We’ve been at full capacity for seven years, and while we do have openings, we can’t bring in all the companies that want to be here, because there’s been quite a demand,” says PABC chief operating officer Louis P. Kassa. “This new project is going to double our lab space, give us an opportunity to start an accelerator, and give the scientists and researchers in the region an opportunity to accelerate their scientific technologies.”

This added capacity at PABC and all of the developments currently under construction continue to raise the potential for what the life sciences can offer the region — and what the region can offer the life sciences. Thomas likens Philly and the combined efforts of the region’s developers to a skilled NBA team carefully building out its repertoire while its star player readies for prime time.

“When the CBRE ranked Philly eighth last year, that was great, but that was sort of our ’89 Jordan moment, where he’d developed all these skills that prepared him to go to the next level,” he says. “I think we’re really developing our life sciences artillery — we’re going into manufacturing, we’re thinking critically about our real estate, and we’re thinking about how we can start training people in Philadelphia who can really benefit from working in this industry. When you look at NIH funding, venture capital, and real estate availability, all those things are on the rise. So I really think we’re going to be 1996 title-winning Jordan soon enough, as we continue to build out our skills and our real estate.”

Published as “Philly’s Next Big Boom” in the December 2020 issue of Philadelphia magazine.