City vs. Suburb: 92% of Philly Venture Capital Funding Went to Suburbs

Source: JLL Research, PwC Moneytree, the National Venture Association with data from Thomson Reuters.

Although the startup buzz is palpable in Center City — where tech meetups, hackathons and pitch events are the norm — most of the venture capital cash in the Philly region is going to companies headquartered in the suburbs.

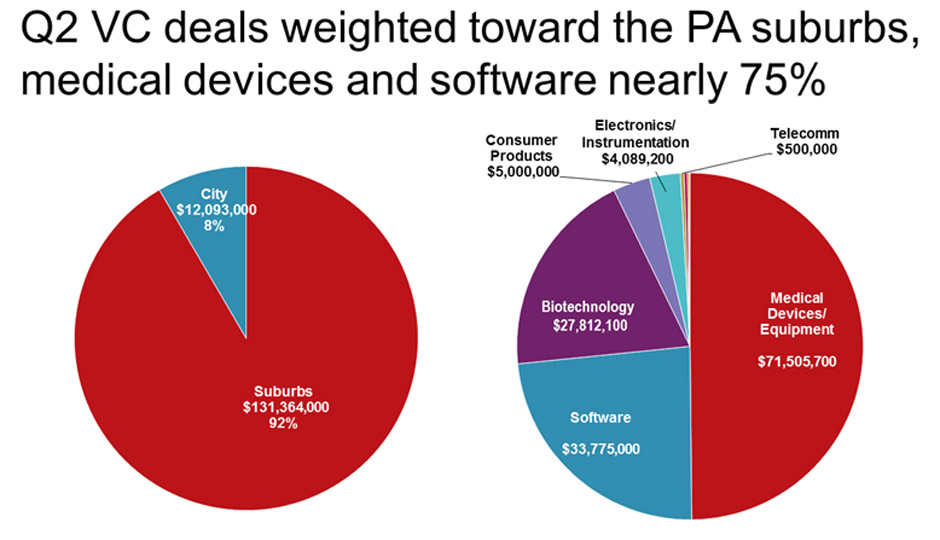

In fact, a new study found that 92 percent of the venture capital funding raised in the second quarter went to companies located in the suburbs (Bucks, Chester, Delaware, and Montgomery Counties.) The entire region raised $143.5 million in Q2, and roughly $131.4 million went to companies located in the suburbs. Just 8 percent (approximately $12.1 million) went to companies in the city.

The data comes from a JLL study of PwC Moneytree research. See the methodology here.

In Philadelphia, the largest raises were Honeygrow Restaurants ($5 million) and ChargeItSpot ($4.1 million.) In the suburbs, Intact Vascular, Neuronetics, Coredial, and InfaCare Pharmaceutical all raised more than $20 million each. All the suburban funding rounds were late stage, aside from Intact.

Of the $143.5 million in venture funding in the region, $83.3 million went to late-stage companies and $50.1 million went to early stage businesses.

Here’s how the funding breaks down by industry:

- $71.5 million: Medical devices/equipment

- $33.7 million: Software

- $27.8 million: Biotechnology

- $5 million: Consumer products

- $4.1 million: Electronics/Instrumentation

- $500,000: Telecom