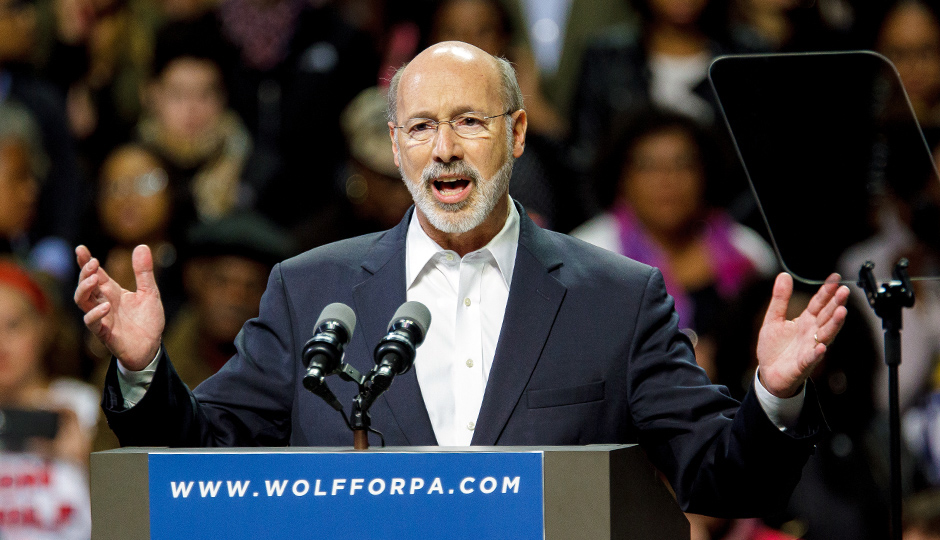

BizFeed: Gas Drillers Are Not Happy With Tom Wolf

1. Wolf, Frackers in Heated Dispute

The News: On the campaign trail, Gov. Tom Wolf promised to tax natural gas drilling in an effort to fund education. It was one of the key platforms that got him elected.

Now that Wolf is in office, members of Pennsylvania’s natural gas sector are questioning the governor’s commitment to the booming industry. In fact, the Wall Street Journal reports that they’re not too pleased with Wolf’s recent actions to propose stricter drilling rules to curb wastewater contamination and heavily fine companies for wrongdoing. In fact, Wolf’s regulators just imposed an $8.9 million fine against a gas operator, the largest ever in the state.

Why It Matters: Wolf wants a 5 percent severance tax on Shale drilling but is currently at odds with the Republican-led state legislature in a wide-ranging budget fight that doesn’t appear close to a resolution. Wolf argues that the tax would generate $1 billion for schools, the WSJ reports.

But the industry argues that it’s creating jobs and revenue for the state. In fact, the WSJ reports that state and local governments will receive $224 million from fracking fees this year alone. The WSJ quoted Dave Spigelmyer, president of the Pittsburgh-based Marcellus Shale Coalition: “This administration’s words continue to be alarmingly detached from its actions as it relates to policy and regulatory matters.”

2. Hit the ATM Without Your Card

The News: WSFS Financial Corp. has unveiled a card-less way to take money from the ATM machine. The Wilmington, Del.-based bank uses a customer’s mobile app to help make the transaction.

The Philadelphia Business Journal explains: “When visiting a branch’s ATM, the customer presses a button that says “Mobile Cash” and a QR code is presented on the ATM’s screen. After signing in with a passcode or touch identification, the customer taps “Mobile Cash” within the app, scans the QR code, selects the desired amount of money and submits it before the cash dispenses.”

Why It Matters: Innovation in banking shows no signs of stopping. From taking a photo of a check to bank with your mobile phone to Citizens’ removing tellers from around 40 percent of its branches, the industry should look very different 10 years from now.

3. Towers Watson, Willis Merge in $18 Billion Deal

The News: Say hello to Willis Towers Watson. The new company will be formed after the merger of one of the largest insurance brokers (Willis Group) and one of the largest professional services organizations (Towers Watson.) It’s an $18 billion deal.

Why It Matters: The merger brings together two huge players and will create a behemoth with “39,000 employees in more than 120 countries and revenue of about $8.2 billion,” the Wall Street Journal reported. The Associated Press has more:

“Willis and Towers expect between $100 million and $125 million in cost savings within three years of closing. Shareholders of financial services company Towers Watson & Co. will receive 2.6490 Willis shares for each Towers share. They will also receive a one-time cash dividend of $4.87 per Towers share.”