Renting 101: How to Avoid the Summertime Scam

If the offer looks like pie in the sky, it probably is. | Image: ElyssaHo via iStock

You may have thought you had finished school, but we think it’s time to go back for a much-needed summer-school session on the basic renting dos and don’ts, especially now that the high rental season is upon us. At this time of year, many would-be renters end up both without a home and in a hole because they fell for an online apartment listing that turned out to be bogus.

Ergo, today’s crash course is all about rental fraud and how to detect deception. The apartment listing service RentHop has come up with several useful tips for spotting scams before you fall for them, based on data gathered in their own processes for verifying listings. Read on below or check out RentHop’s blog post for the full scoop on how to steer clear of swindlers.

Without further ado, here’s your ultimate cheat sheet on cheating.

Three Absolute No-Nos

One: Say no to escrows. If your contact is asking for wired money upfront via Western Union, MoneyGram or an escrow service, you’re certainly getting ripped off. The listing doesn’t exist, and your money will likely end up in the hands of some scammer overseas.

Two: See it before you believe it. Don’t hand over the big bucks before you see the space. Excuses from the broker or tales of other offers that necessitate a timely down payment prior to a viewing basically mean you’re being duped. Get out ASAP.

Three: Make sure it’s not too good to be true. Everyone loves a bargain. That being said, make sure your bargain is a reasonable one. Some things are, in fact, just too good to be true. RentHop found that if the listed price is less than two-thirds of what similar listings in the area look like, there’s a 43 percent chance you’re in the midst of a scam. If it’s less than half what similar apartments list for, the odds you’re being scammed rise to 79 percent.

Eight Warning Signs

Four: Double-check domain names. If you end up exchanging email with someone at a Gmail, Yahoo, Outlook or Hotmail address, tread VERY lightly around the offer. Free domain names that don’t correspond with a website can be cause for concern.

Five: ‘You’re a Winner’ probably means you’re going to lose. Turns out you’re not that lucky. In 92 percent of cases where an email or listing used this language, the listing turned out to be fraudulent.

Six: Long excuses should not be excused. Sob stories from contacts about home emergencies and responses over 250 words are definite danger signals. Notes that play on your emotions should scare you away.

Seven: Flexibility is fake. Can you rent for two months or two years? That sounds weird. Newsflash: it is. Step away; reputable agents don’t do business like this.

Eight: Cross-check that bargain listing. If you see an online posting for an apartment with an amazingly low price, go look up its address. If it’s way below the rents listed for other units, the poster’s probably pulling a fast one. You could also call the property manager to make sure.

Nine: Email address changes could raise concern. Cue your inner skeptic if your contact is switching communication mediums or using multiple email addresses.

Ten: Are you sure that’s who you’re talking to? Are you corresponding with someone who claims they were a doctor, consultant or missionary? If so, it’s a big yellow flag, for these are the most common backgrounds traditional scammers use. But beware: more sophisticated scammers have been known to impersonate reputable brokers and owners. Do a search on their domain names and street addresses to verify who you’re talking to.

Eleven: Beware the share of credentials. People don’t typically overshare. If your correspondent is excessively pushing official documentation such as licenses in your face, beware. Look for blurred lines, uneven fonts and different fonts in the files they send you.

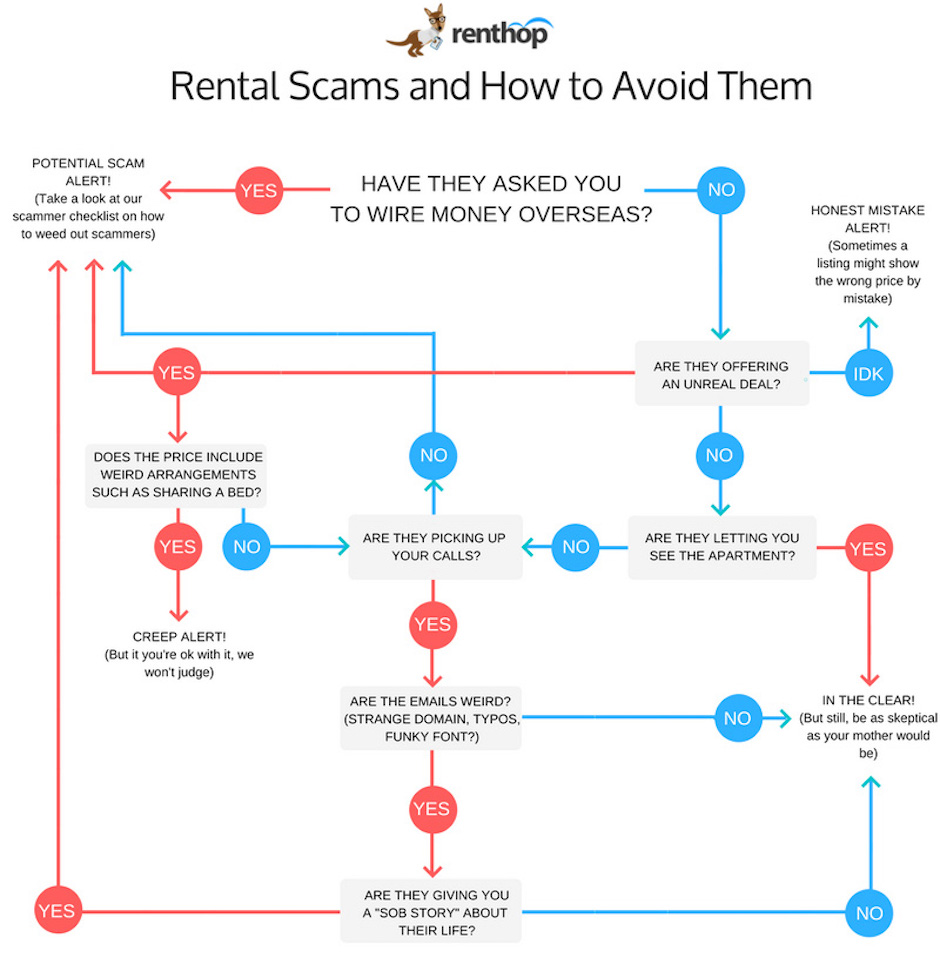

The flow chart below breaks all this down for you.

Image via RentHop