State House and Senate Send Spending Bill to Wolf

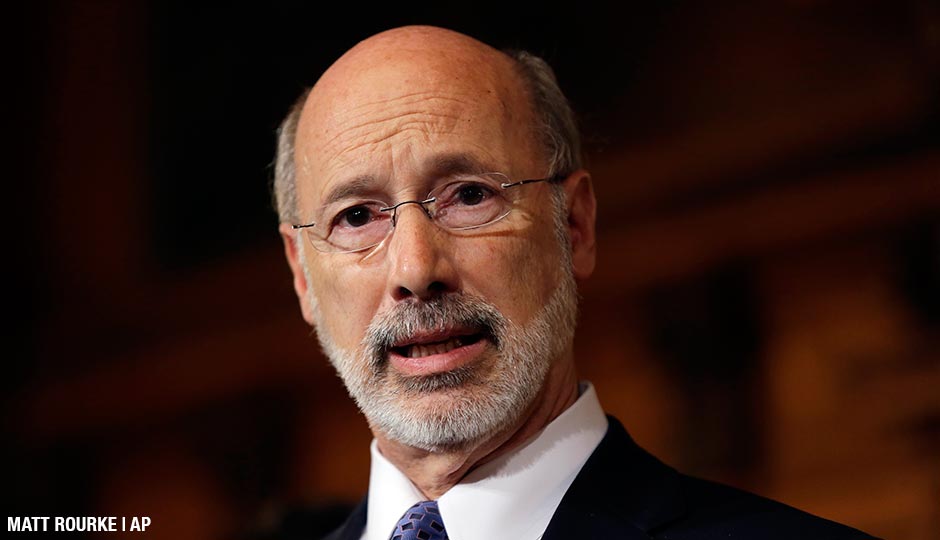

Tom Wolf | Photo: Matt Rourke, AP

The Pennsylvania House of Representatives voted Thursday evening to adopt a spending bill for the next fiscal year, with hours to spare before the midnight deadline. The bill was approved by the state Senate on Wednesday. Governor Tom Wolf said he will sign the bill, but only after lawmakers finalize a plan on how to finance it.

“I want to commend leaders and members in both chambers for passing a bi-partisan, compromise budget that invests more money in early childhood, K through 12 and higher education, and also provides vital resources to combat the heroin crisis,” Wolf said in a statement Thursday night. “I am pleased that working together we took this important step to move the commonwealth forward. I will sign the General Appropriations bill as soon as there is a sustainable revenue package to pay for it, and I look forward to continuing to work with the legislature to achieve this.”

While the full budget package isn’t set in stone, the delivery of an on-time appropriations bill is a stark about-face from the nine-month impasse of last year’s budget process. Throughout the latest budget season, Wolf has stressed the need to pass a balanced budget, one that matches all spending with stable revenue. In his budget address in February, Wolf warned lawmakers that a $1.8 billion structural budget deficit could cripple the state unless a balanced budget were passed.

The spending plan includes a $200 million increase in basic education funding across the state, including an additional $47 million for Philly schools. It also includes $10 million to fund new initiatives to fight heroin addiction. Wolf made both issues a priority of his budget proposal, but sought more money for each—$250 million for schools and $34 million for opiate programs.

As of Thursday night, lawmakers were still discussing how to pay for the budget. Wolf had initially sought increases to the state income and sales taxes, but later agreed not to raise them. Legislators are considering increasing taxes on tobacco products, including a possible $1-per-pack hike to the cigarette tax, as well as new revenue from expanded gambling and liquor sales.

Follow @jaredbrey on Twitter.