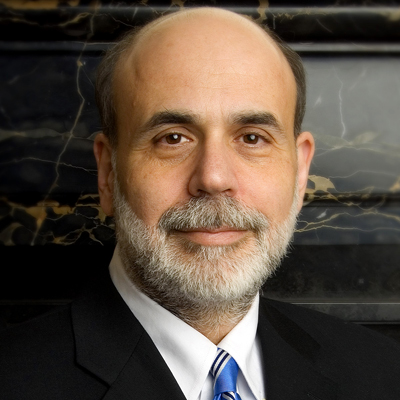

In Philly, Ben Bernanke Says Individuals Should Have Been Charged in Economic Crisis

According to Ben Bernanke, the United States economy is doing just fine.

During a recent talk at the Philadelphia Free Library, the former chairman of the Federal Reserve said he’s optimistic about the country’s economic future, saying there’s no new housing bubble and that the country is moving towards full employment.

“The domestic economy is moving forward pretty well. Households are in pretty good financial shape overall. They reduced their debt and interest payments quite a bit. The housing market is coming back,” said Bernanke, in town to promote his book The Courage to Act. “There are a lot of things moving the economy forward.”

When asked if there’s bubble in Philadelphia’s growing housing market, Bernanke briefly said, “no.”

Bernanke believes that the main risk today is on the global stage. But he was still surprised by Wall Street’s sell-off in late August due to fears about China’s slowing economy. It resulted in the biggest U.S. stock market plummet in four years.

“We knew [China’s economy] was going to slow down. It has to slow down. You can’t grow at 10 percent forever,” said Bernanke. “China has been trying to make a transition from its earlier model which was a heavy industry, infrastructure, export, top-down model to a more bottom up, market-oriented, consumer led, high-tech economy. That transition is going to be uncertain in terms of how rapid growth is going to be. We knew that was happening.”

Bernanke explained that the market might have underestimated the negative effect on countries that rely on exporting commodities to China, like Mexico and Russia.

“If there’s a surprise it’s that the emerging markets haven’t adjusted and adapted to the slowing China situation to the extent we thought the would.”

When asked why nobody has been held criminally responsible for the economic crisis — Bernanke said that’s not really accurate, since people have been charged with insider trading and other crimes. Still, he’s not happy that the Department of Justice has gone after corporations, not people.

“The Department of Justice’s strategy in many cases has been to fine big institutions,” he said. “Bank of America paid $14 billion in fines for various kinds of malfeasances. Corporations are just legal fictions. They don’t commit crimes. I think we would have been better served if they focused on individual responsibility and less on corporate responsibility. That was a mistake. I think people should be held responsible if they broke the law.”

On the topic of student loans, Bernanke sees it as a problem, but not one that will cause the country deep financial harm.

“Banks don’t make student loans anymore. Ninety-seven percent of all student loans are federal government loans,” he said. “If they don’t get paid back, it’s obviously bad for the taxpayer, but it’s not going to bring down the financial system like subprime mortgages did.”

Although Bernanke graduated without student loans and paid off his tuition by taking summer jobs at South Carolina’s famous South of the Border, he said both of his two millennial children are attending medical school and owe “a substantial fraction of the GDP” in debt.

“They have enormous debt. But the good news is, as they become doctors, obviously they will have some income to pay it back,” he said. “The real trouble is people who take out money and don’t graduate or get in a field that doesn’t really have any jobs.”

But the answer isn’t to get rid of student loans but to instead counsel people to be “realistic about how much money they’re taking out, understand what the consequences are, how much they have to pay, [and if] the professional courses they’ve chosen realistic.”